Formally known as the “Public Company Accounting Reform and Investor Protection Act” in the US Senate and as the “Corporate and Auditing Accountability and Responsibility Act” in the House of Representatives, Sarbanes Oxley (SOX) is a landmark legislation that the American Congress passed in 2002. Named for the sponsors of this Bill, senators Paul Sarbanes and Mike Oxley, it was passed in the wake of the financial scandals of huge American corporations that rocked the American economy, such as Tyco, Enron, WorldCom, Arthur Andersen and Global Crossing among others that shook investor confidence.

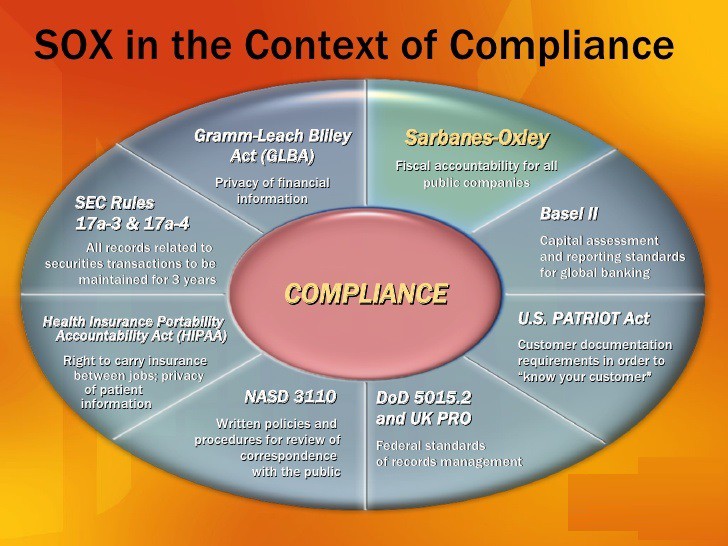

Effective from 2006, what SOX does is to mandate laws for strict accountability from firms that do business in the US. This included not only American, but foreign firms as well. The aim of SOX was to stipulate a broad and strong accounting framework for all companies that do business in the US. SOX consists of eleven sections. Among its most important provisions are the establishment of a Public Company Accounting Oversight Board (PCAOB) under the Security and Exchange Commission (SEC) and the designation of civil and criminal penalties for companies that are found to be noncompliant and violative of the provisions.

Making companies more accountable financially

The crux of the requirement is for companies to establish a framework for financial accounting which will enable them to generate thoroughly verifiable financial reports whose data source should be traceable. The data should also have electronic information of all details of access, such as who accessed what data, when it was done, what was done during the access, and what action was carried out.

Since SOX compliance is mandatory for most companies, how does it feel to comply with the provisions of this Act? If we are asked to speculate what SOX compliance will look like in the future, we need to look at it from the standpoint of technology. This is because technology is inseparable from accounting. Most transactions are electronic in nature. Technology has taken us to a point where manual recordkeeping and accounting are almost totally obsolete.

This is how SOX compliance will look like in the future

In this backdrop, prognosticating how SOX compliance will look like in the future is tentative. This is because of the changing nature of technology. Technology, as we are aware, keeps changing by the minute. As more technological advances are made, it is only natural to expect them to be incorporate into technology-dependent and technology-propelled activities that SOX requires. It is a lot easier to trace transactions today than they were a decade ago.

Technology, as we are all aware, is totally unpredictable. Even as SOX-compliant systems start getting used to a technology, updates and developments into it could trigger the need for more amendments. An unexpected development can throw the whole adaption process asunder.

Uniqueness which could make it the ultimate technology https://goo.gl/kNBRGA

![This is How SOX Compliance will Look like in the [Future]](https://compliance4all14.files.wordpress.com/2018/10/the-four-pillars-of-a-digital-sox-png.jpg?w=1170)

![Exploring the Fundamentals of [Blockchain]](https://compliance4all14.files.wordpress.com/2018/09/blockchain_0.gif?w=770)

![1st Decentralized Video Search Engine Aivon Launches [Blockchain]](https://compliance4all14.files.wordpress.com/2018/08/blockchain-technology-1000x520.jpg?w=1000)